|

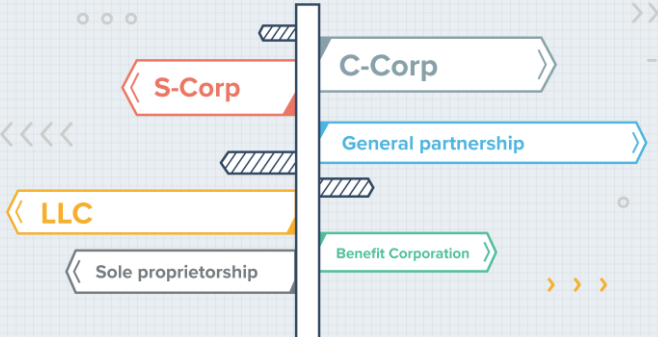

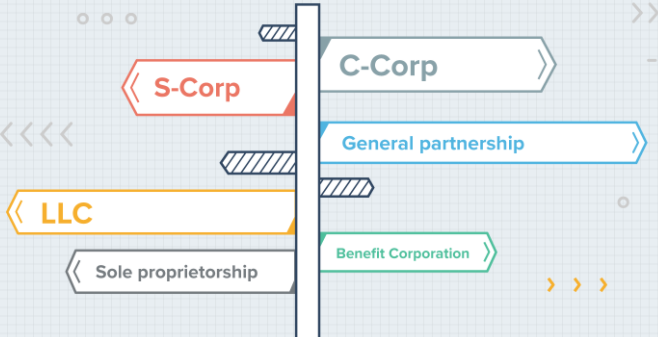

SOURCE of JPEG Graphic: http://gust.com/launch/blog/choose-incorporation-type Start-up business owners tend to ask these three main questions : 1) Which business formation type should I use? 2) How do I get funding? 3) Who can write my business plan? David S. Rose, Founder and CEO of Gust wrote a Forbes article, "How to Fearlessly Choose an Incorporation Type For Your Start-up." Mr. Rose has started or helped to start 100+ companies. He explains why a Sole Proprietorship is still good and how a C-Corporation can be more beneficial than an LLC at times. His stance is in stark contrast to the constant drumbeat from attorneys and accountants who push for SMEs to become limited liability companies. The general opinion of McDaniel Consulting is that an LLC should only be formed once you actually know the related IRS tax consequences of doing so. If your attorney or CPA can't explain in nauseating detail the bottom-line advantages of being an LLC, a different form of business may be better for you. You may also go as far as purchasing IRS Tax Software from H&R Block or Tax Cut to run a general scenario of what your taxes could look like at the end of the year. This will help you to better understand which business entity is most ideal. You may also ask your lending institution for suggestions on which entity is most suitable for the type of funding that you're seeking. Investors may prefer a C-Corp. A microlender may be more willing to work with you as a proprietor. A banker may accept an LLC, but will likely also want to see your personal financial statements. Funding on all levels depend on your stage of business, business credit, personal FICO, and length of time in business. A thorough business plan includes a detailed marketing analysis section which address issues that lenders and investors have. However, one of the first questions that a business plan writer will ask you is, "Which form of business is your company?" McDaniel Consulting in Dallas is know for its SBA Investor Ready Business Plans. Read the article by David S. Rose before calling them with more questions. Here's the link to that awesome article. Original Forbes Magazine Article Link - https://www.forbes.com/sites/groupthink/2017/12/05/how-to-fearlessly-choose-an-incorporation-type-for-your-startup/#2f731f744327 The David S. Rose Blog Post - http://gust.com/launch/blog/choose-incorporation-type Click here for the Business Formation Chart - http://gust.com/launch/how-to-pick-a-legal-entity.png This article is intended for informational purposes only and doesn't constitute tax, accounting, or legal advice. Everyone's situation is different! Consult with a tax advisor, State-sanctioned accountant, or State-sanctioned attorney for advice that is specific to your unique circumstances.

Comments are closed.

|

AuthorSyreeta V. McDaniel, MBA provides business consulting to entrepreneurs throughout the U.S. and 15+ countries. She is best known for Strategic Business Plan Writing, Gov't Contracting and Int'l Business. She enjoys making organic treats for her dogs. Archives

June 2023

Categories |

RSS Feed

RSS Feed