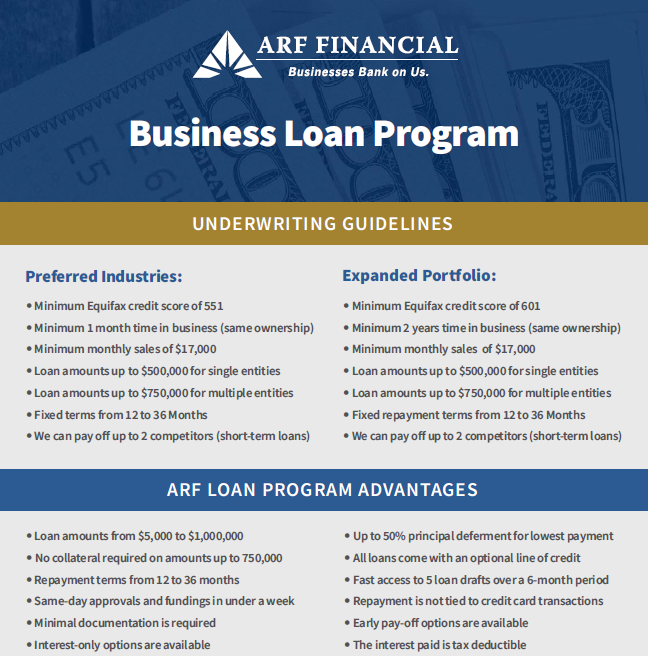

The business loan option below are for existing businesses. A business plan is not necessary to apply for these loans. Click HERE to apply or click the image to begin the loan process. You will have a decision within three (3) days. Read full details below

|

TO PREQUALIFY

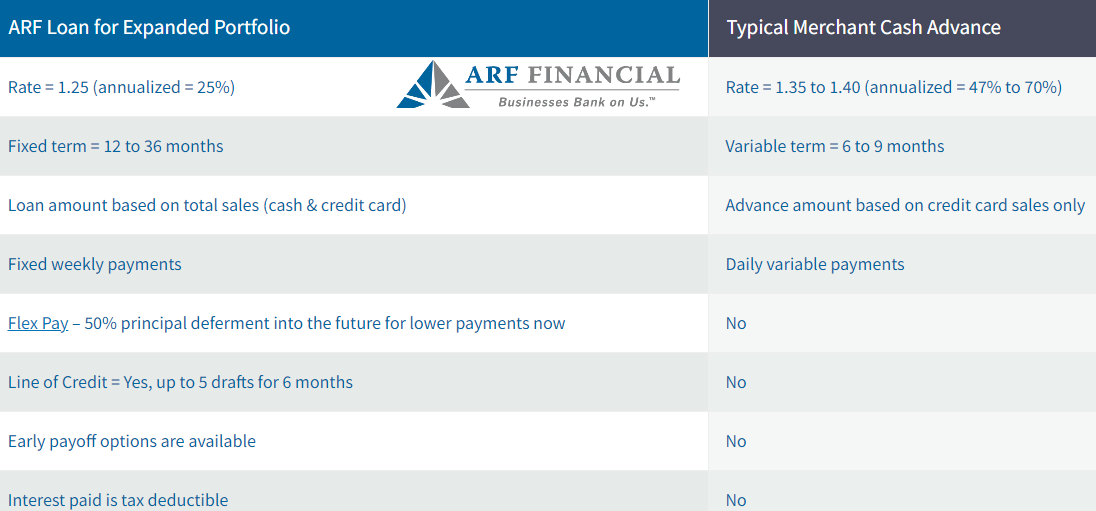

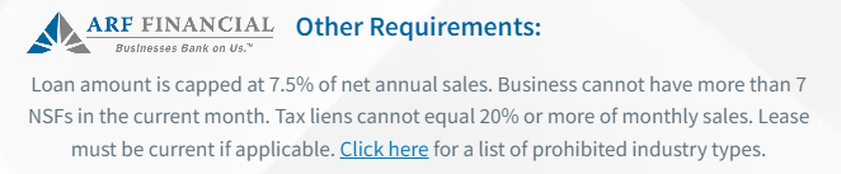

1.Must be brick and mortar restaurant or hospitality business, hotel, motel, auto repair and service, medical, dental, or certain retail establishments (detailed list at www.arffinancial.com/industries) 2.Open and operating for at least 1 month (30 days) 3.Minimum annual sales of $200,000 (actual or projected) 4.Guarantor with a personal FICO score of 551 or higher 5.Client may have a maximum of 2 outstanding cash advances (short-term loans) 6. Merchants may qualify for up to $500,000 (single-unit) or $750,000 (multi-unit) without review of tax returns and financials 7. Loan terms from 12 to 36 months, CLICK HERE TO APPLY 8. Our loans do not require a review of tax returns and financials REFERRAL PARTNER MEMBERSHIP PROGRAM Higher Loan Amounts and Longer Terms are available for Well Established Borrowers. Businesses may qualify for amounts up to $500,000 without the need for collateral, at the most competitive rates and with fixed terms up to 36 months. Our loan program is perfect for well established, single-unit and multi-unit business owners who need capital for growth opportunities, slow seasonal fluctuations and unexpected expenses. CLICK HERE TO APPLY NOW Our average loan amount is $120,000. Most importantly, we will lend up to $500,000 (single-unit) or $750,000 (multi-unit) without the review of tax returns and financials and no collateral requirements. That’s the highest threshold in the industry! ARF LOAN PROGRAM ADVANTAGE •We provide loan amounts from $5,000 to $1,000,000 •Collateral is not required on amounts up to $750,000, APPLY •Repayment terms from 12 to 36 months •Tax returns and financials are not required on loans up to $750,000 •Fast approvals and fundings in as little as 3 days •Streamlined approval process and limited paperwork requirements •The interest paid is tax deductible •Early pay-off options are available •Repayment is not tied to credit card transactions BEFORE YOU APPLY, ARF WILL NEED TO KNOW THESE THINGS TO GET STARTED 1. How long have your been in business for the business entity that you are in (same ownership, concept and location), APPLY 2. Do you have an idea of your Personal FICO credit score: Excellent = 700 + ; Good = 651 – 699 ; Fair = 601 – 650 ; Poor = 551 – 600 ; Unqualified = Less than 551 3. What are your average monthly cash and credit card business sales for last 3 months 4. Do you own a home and are you current on your mortgage HOW MUCH LOAN CAN YOU RECEIVE - POTENTIAL LOAN AMOUNT ARF uses actual gross sales to determine your loan amount. Potential loan amounts vary from 6% to 33% of total annual sales (cash + credit card sales – actual or projected) based upon the guarantor’s credit worthiness. Example: If the average monthly sales volume is $100,000 or $1,200,000 annually, the potential loan amount is $72,000 to $396,000. If sales increase over time, the merchant may qualify for additional capital. CLICK HERE TO APPLY All loans are subject to ARF Financial’s standard underwriting criteria. |

Syreeta V. McDaniel, MBA formed McDaniel Consulting GBSFE in year 2001. Find out more by watching our video bio. Further attested to by: New York Times Magazine, Woman's Day Magazine, Dallas Morning News, Emerging Business Magazine, etc. Aside from watching the video, read the full Media on our original home page at http://mcdanielconsulting-gbsfe.com/mc-about-media.htm