|

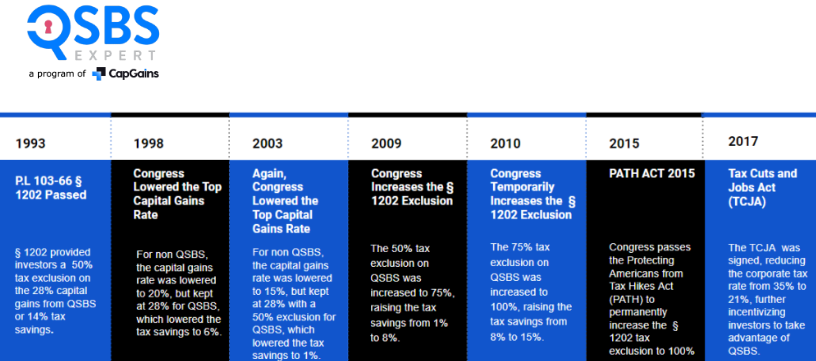

McDaniel Consulting GBSFE has shared a method for clients to attract investment dollars by sharing the tax benefits to their investors. The U.S. Internal Revenue Code 1202 allows for tax benefits of small corporations. The option is also known as #QSBS Qualified Small Business Stock. It ultimately gives your corporation the ability to accept investment dollars so that your firm can grow. The law was established since year 1993. Your investors may be able to write off their 100% capital gain if they hold the investment for 5 years. Read through every resource link below to better understand this option. These video and resource links are for educational purposes and are not an endorsement of any kind. TAKEN FROM GUST.COM “What is a QSBS exemption and would my C-Corp qualify? The Qualified Small Business Stock exemption allows a C-Corp's stockholders to write off 100% of personal taxes on gains from the sale of the stock over its original purchase price after five years of ownership. The maximum write-off is $10,000,000 or 10 times the aggregate adjusted basis of the QSBS stock (whichever is higher). The potential tax break on a successful exit with QSBS is massive, and virtually all newly-incorporated, high-growth US C-Corp startups would meet the requirements: the QSBS exemption can apply to stock issued by an active, domestic C-Corporation with less than $50,000,000 in assets. ..." https://gust.com/launch/faq/articles/what-is-a-qsbs-exemption-and-would-my-c-corp-qualify Here is the original language from the U.S. Internal Revenue Code and additional info on the U.S. Internal Revenue Service website - https://www.irs.gov/pub/irs-regs/ia2694.txt# Click here for "Section 1202: A Big Deal for Small Business," by the American Bar Association, Matthew E. Rappaport of Falcon & Berkman and Caryn I. Friedman of Ernst & Young, Washington D.C., https://www.americanbar.org/groups/taxation/publications/abataxtimes_home/18aug/18aug-pp-rappaport-friedman-section-1202/ Click here for "How To Receive Full Gain Exclusion With Qualified Small Business Stock QSBS," by Adam Sweet, JD, LLM in September 2021 - https://www.eidebailly.com/insights/articles/2021/9/how-to-receive-full-gain-exclusion-with-qualified-small-business-stock-qsbs Click here for "Qualified Small Business Stock Exclusion Eligibility," by Meghan Andersson, JD LLM, November 2021 - thetaxadviser.com/issues/2021/nov/qualified-small-business-stock-exclusion-eligible.html Click here for details on "Qualified Small Business Stock," by Kristin McKenna, CFP, January 2022, https://darrowwealthmanagement.com/blog/qualified-small-business-stock/ Click here for Forbes article "IRS Limits Qualified Small Business Stock Tax Exclusion," by Daniel Mayo, January 2022 - https://www.forbes.com/sites/danielmayo/2022/01/31/irs-limits-qualified-small-business-stock-tax-exclusion/amp/ Click here for "IRS Ruling Provides Insight Into Section 1202 Qualified Small Business Stock," by Benjamin Aspir, CPA, MST, Eisner Advisory Group, July 2022, www.njcpa.org/article/2022/07/05/irs-ruling-provides-insight-into-section-1202-qualified-small-business-stock Click here for "The Qualified Small Business Stock Tax Benefit," by Carta.com April 2023, https://carta.com/blog/qsbs/ Click here for "How Individuals Can Qualify for Qualified Small Business Stock QSBS Exclusion," by Rashida Motiwall, CPA, MBA, February 2023 - https://www.lga.cpa/resources/how-individuals-can-qualify-for-qualified-small-business-stock-qsbs-gain-exclusion/ https://www.businessplansforsba.com/blog/qsbs-irc1202 #WhatIsQSBS?, #IRC1202, #QualifiedSmallBusinessStock

|

AuthorSyreeta V. McDaniel, MBA provides business consulting to entrepreneurs throughout the U.S. and 15+ countries. She is best known for Strategic Business Plan Writing, Gov't Contracting and Int'l Business. She enjoys making organic treats for her dogs. Archives

June 2023

Categories |

RSS Feed

RSS Feed